How To Add Apple Pay To Shopify: Is It The Best For Conversions?

I'm looking for...

Apple Pay is quickly becoming a hot topic among ecommerce business owners and for good reason. So, wondering how to add Apple Pay to Shopify? Don’t worry, I got your back!

This payment system, designed by Apple Inc., allows customers to make secure and speedy transactions with just a touch or a glance.

By enabling Apple Pay on your Shopify store, you’re not just offering convenience; you’re also providing a payment gateway that’s synonymous with security and trust.

So let’s dive into why adding Apple Pay as a payment option is more than a smart move—it’s practically essential for keeping up with the demands of today’s online shoppers.

Create Your Online Store in just 5 Minutes – For Free

Pick your niche, our AI builds your store, add 10 winning products and we teach you how start selling today. Start picking your niche

The Advantages of Accepting Apple Pay on Your Shopify Store

With the rise of mobile commerce, it’s essential to offer a smooth and secure mobile checkout experience in your Shopify store.

So, enter Apple Pay – a payment solution designed with convenience and security at its core.

Streamlined Checkout Process

Streamlined Checkout Process

Apple Pay enhances the checkout process by streamlining transaction steps.

So, instead of manually entering card details, customers simply authenticate their purchase via facial recognition or fingerprint scan.

This seamless process reduces the chance of customer drop-off, commonly seen at the payment stage due to cumbersome data entry.

Increased Conversion Rates

Increased Conversion Rates

So, how does this affect conversion rates? Let’s back it up with some numbers.

According to a case study by BigCommerce, merchants who accepted Apple Pay saw an increase in conversion rates by up to 25%. That’s impressive!

Higher Purchase Completion Rate

Higher Purchase Completion Rate

But there’s more good stuff! Apple Pay doesn’t just improve the user experience; it also meets the transactional intent of customers head-on.

Customers who choose Apple Pay are typically ready to purchase, contributing to a higher rate of purchase completion.

In essence, integrating Apple Pay into your Shopify store not only simplifies the checkout process but also directly influences your bottom line.

It’s like hitting two birds with one stone – enhancing customer experience while driving sales growth!

How to Enable Apple Pay on Shopify?

Enabling Apple Pay on your Shopify store can be a game-changer for you and your customers.

By offering this payment method, you’re tapping into the ease and security that today’s online shoppers are looking for.

So, here’s how you can add Apple Pay to your Shopify store.

Step 1: Check Your Eligibility

Before diving in, ensure that your store’s payment provider is compatible with Apple Pay.

Shopify Payments, which is available in multiple countries, supports Apple Pay out of the box.

If you’re using a different payment gateway, check with them or look at Shopify’s list of supported providers.

Step 2: Activate Shopify Payments

If you haven’t already:

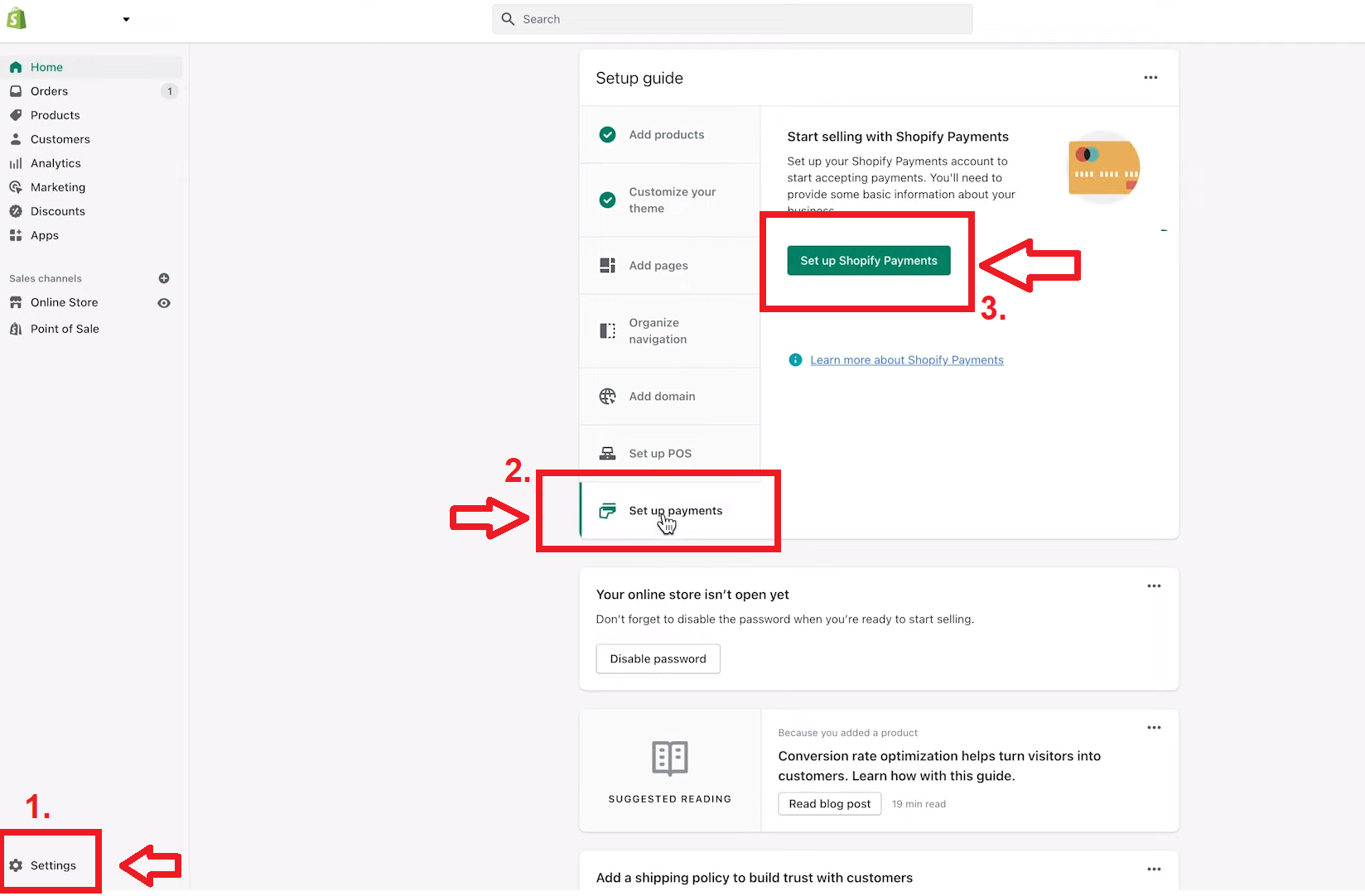

- Go to your Shopify admin panel.

- Click on ‘Settings’ at the bottom left corner.

- Select ‘Payment providers’.

- If you’re already using a different provider, click ‘Change provider’.

- Choose ‘Shopify Payments’ and follow the setup instructions.

Step 3: Enable Apple Pay

With Shopify Payments activated:

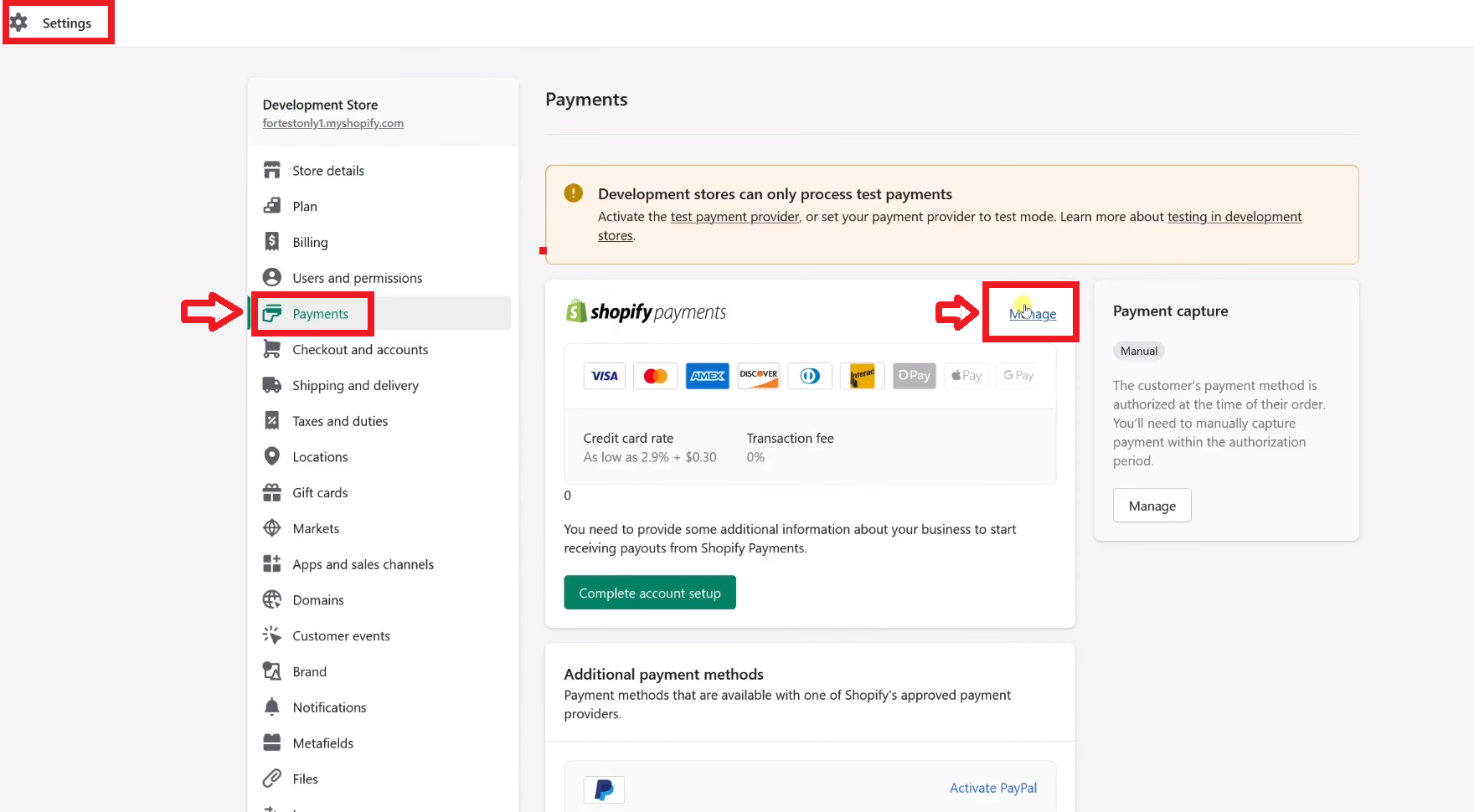

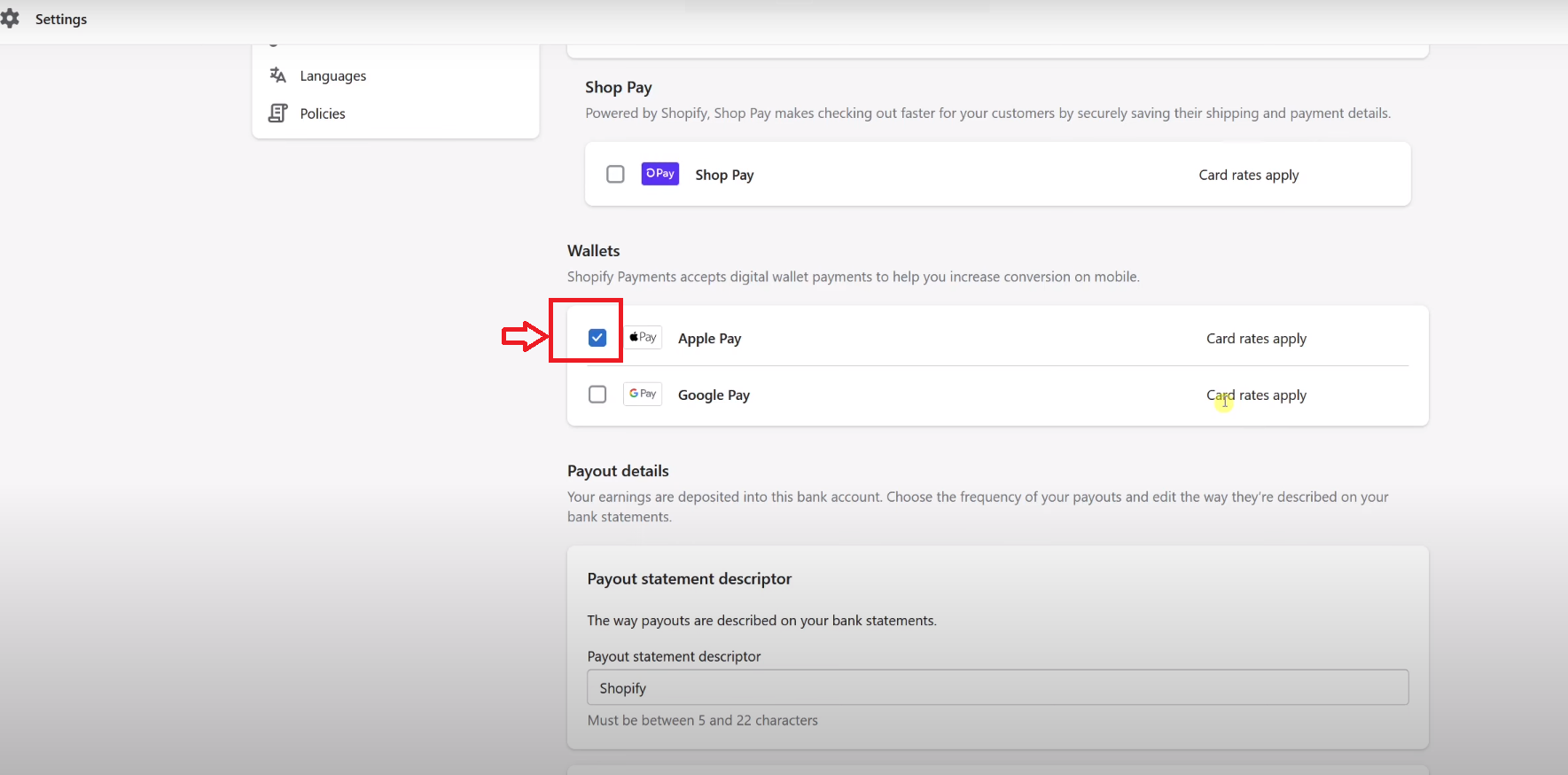

- In the same ‘Payment Provider’ section, find the ‘Apple Pay’ section.

- Click on ‘Manage’.

- You’ll see an option to activate Apple Pay – toggle it on.

Step 4: Ensure You Have an SSL Certificate

Security is vital – for both you and your customers. An SSL certificate encrypts data and ensures secure transactions, which is non-negotiable when enabling Apple Pay on Shopify.

SSL Certificate

Usually, Shopify provides an SSL certificate for your store by default. Thus, it’s essential to check that it’s activated:

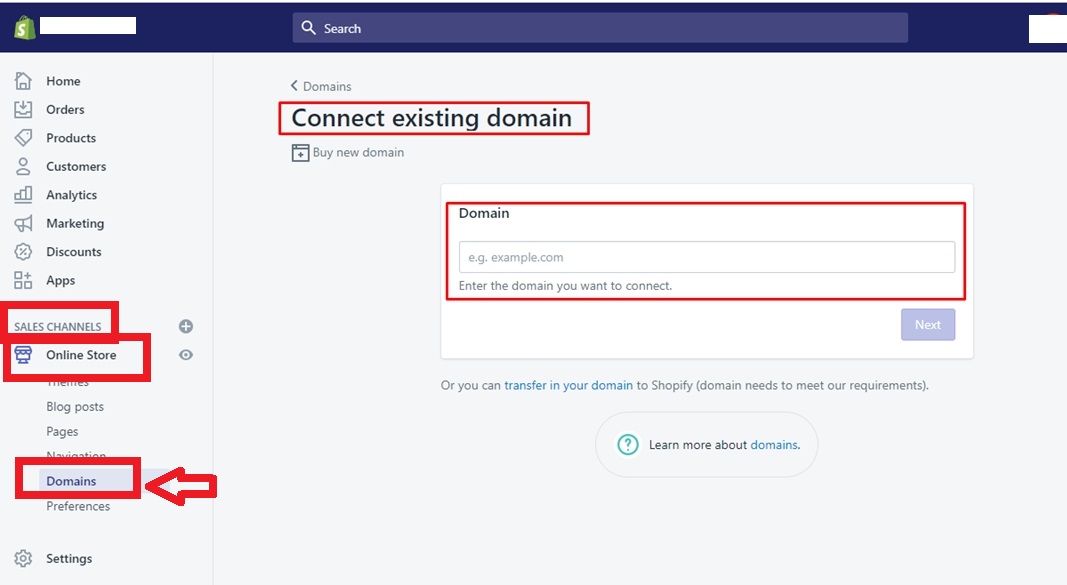

- Visit ‘Settings’ > ‘Domains’ in your admin panel.

- Ensure that ‘SSL certificates’ are enabled for your domain.

If there are any issues with your SSL certificate:

- Often, it might just be a matter of time before it gets issued and activated automatically.

- If it’s taking longer than expected, reach out to Shopify support for assistance.

Step 5: Test Your Setup

After setting up Apple Pay:

- Go through a test transaction using Apple Pay as your payment method.

- Address any issues if the payment does not go through smoothly.

Troubleshooting Tips

If you encounter problems while setting up or testing:

- Verify that all domains used in checkout are added in your Shopify admin under ‘Domains’.

- Confirm that your browser is running the latest version since older versions might not support Apple Pay.

Now that you’ve got Apple Pay up and running on your Shopify store, remember to monitor its performance alongside other payment methods.

Also, keep an eye on the checkout flow to ensure everything runs smoothly for customers using this service.

Ensuring Compatibility and Optimizing for Apple Pay Checkout

When it comes to embracing Apple Pay, your Shopify store needs more than just enabling the feature — it requires mobile optimization that aligns with user behavior.

Most iPhone users expect a frictionless shopping experience, which means having a responsive design that adapts to their device’s screen size and an intuitive button placement for easy navigation.

Why Optimize for Apple Pay?

- Seamless Experience: Customers are more likely to complete purchases with minimal taps or swipes.

- Higher Conversions: A well-optimized checkout process can reduce cart abandonment rates.

- Brand Trust: Smooth functionality reflects on your brand’s commitment to quality and security.

Compatible Devices for Apple Pay on Shopify

To cater to the broadest range of customers, ensure that your store supports the following devices:

- iPhones: Specifically iPhone 6 and later models, where Apple Pay is readily accessible.

- iPads: Including iPad Pro, iPad Air, iPad, and iPad mini models with Touch ID or Face ID capabilities.

- Mac Computers: For users who prefer to shop on desktop but enjoy the continuity with their Apple devices.

- Apple Watch: For on-the-go purchases, streamlining the checkout even when away from the phone or computer.

Integration of iOS Buy SDK

For a truly integrated shopping experience, incorporating the iOS Buy SDK into your Shopify store is essential. This toolkit facilitates a direct connection between your store’s inventory and the customer’s Apple Pay wallet. Here’s how it benefits you:

- Customizable Checkout Flow: You can tailor the payment process to match your store’s branding and user interface.

- Streamlined Payments: The SDK provides a smooth transition from product selection to transaction completion using Apple Pay.

- Enhanced Performance: With native support for iOS devices, the checkout process is optimized for speed and reliability.

By prioritizing these optimizations, you not only cater to iPhone users but also elevate the overall shopping experience across all devices. This strategic approach can lead to improved customer satisfaction and increased sales for your Shopify store.

Security Measures for Apple Pay Transactions on Shopify

Security Measures for Apple Pay Transactions on Shopify

When you integrate Apple Pay with your Shopify store, you’re not just offering a slick payment option, but also fortifying your checkout process with robust security measures. Apple Pay incorporates a sophisticated tokenization system that’s all about keeping customer data under lock and key. Here’s the scoop on how it works:

Unique Transaction Codes

Unique Transaction Codes

Instead of transmitting actual card numbers, Apple Pay generates a unique transaction code for every payment. This means sensitive credit card information never enters your store’s ecosystem, drastically reducing the risk of data breaches.

Device-Specific Numbers

Device-Specific Numbers

To add another layer of security, Apple assigns a unique device number to every transaction. It’s like having an uncrackable password that changes with every purchase.

But let’s not forget about the compliance side of things. Adhering to PCI compliance is akin to following a gold-standard set of rules that ensure all credit transactions are up to snuff when it comes to security.

Shopify’s Role

Shopify’s Role

Fortunately, if you’re using Shopify, they’ve got PCI compliance covered as part of their service.

Thus, it ensures that your store meets stringent requirements set by the Payment Card Industry Data Security Standard (PCI DSS).

Merchant Responsibilities

As a merchant, you’ll breathe easier knowing that your customer’s data is protected through industry-leading protocols without needing to navigate complex compliance regulations on your own.

By choosing Apple Pay for your Shopify store, you’re stepping up the game not just for inconvenience but also to provide a secure shopping experience that customers can trust.

Comparing Apple Pay with Other Payment Methods on Shopify

When it comes to ecommerce transactions, it’s not just about offering a variety of payment methods but also considering the cost-effectiveness for you as a merchant.

A key aspect to consider is the transaction fees associated with each payment method.

Apple Pay

Apple Pay, like other digital wallets, does not charge extra fees for its use on Shopify.

It’s part of the Shopify Payments system and follows the same fee structure. For basic Shopify plans, the fee is 2.9% + 30¢ per transaction.

PayPal

Another popular choice is PayPal, which has a similar fee structure at 2.9% + 30¢ per transaction.

However, if your store processes payments outside of the US, PayPal’s cross-border fees may apply.

Stripe

Stripe is an alternative to Apple Pay and PayPal with an identical pricing model.

Hence, it offers volume discounts for businesses with large payment volumes and microtransaction optimization for businesses with low average ticket prices.

Amazon Pay

Merchants often opt for Amazon Pay, which charges 2.9% + 30¢ per transaction for domestic U.S. transactions and 3.9% + 30¢ for cross-border transactions.

Despite these similarities in transaction fees, it is worth noting that each method may offer different customer experiences.

For example, Apple Pay uses biometric authentication, offering an added layer of security that might appeal to customers who prioritize secure transactions.

The choice between these payment methods depends largely on your business needs and your customer preferences. It’s about finding that sweet spot where convenience meets cost-effectiveness!

Conclusion

By using Apple Pay on Shopify, merchants can greatly improve the mobile checkout experience. This payment method is not just about keeping up with technology—it’s a vital tool for any Shopify store aiming to make checkout smoother and increase conversion rates.

Enabling Apple Pay directly appeals to tech-savvy shoppers who value convenience and security. It’s a wise move for anyone looking to meet customer expectations and see a noticeable increase in sales.

So why wait? Choose to integrate Apple Pay today and see your Shopify store flourish.

![The Top 21 3PL Companies Compared [2025 List & Guide]](https://images.weserv.nl/?url=https://prod-dropshipping-s3.s3.fr-par.scw.cloud/2024/03/Frame-3922469.jpg&w=420&q=90&output=webp)